As the insurance sector embraces digital transformation and increasingly relies on email communication, safeguarding against email-borne insurance scams has become ever so pressing. The consequences of a successful attack on an insurance business can extend far beyond financial losses, causing reputational damage, regulatory penalties, and a loss of customer trust.

Gain More Insights About DMARC in Insurance Sector

This article aims to show the following:

- Why are insurance client databases so lucrative to bad actors?

- Which insurance scams and cyber threats aim to get the data?

- Why is email authentication the most reliable method for avoiding insurance scams?

Why Do Hackers Target Insurance Companies?

Hackers are always interested in industries that deal with valuable personal data and large amounts of money. The insurance sector has it all, plus it’s also growing at a high rate. Statista predicts the sector will reach $8.4 trillion by 2026.

Personal Data Makes a Great Catch for Identity Theft

Insurance companies handle a vast array of sensitive information for individuals and businesses of all sizes. This includes personally identifiable information (PII), financial records, and medical cards.

Individual policyholders share most confidential details with insurers, including names, addresses, social security numbers, driver’s license information, et cetera. This information provides an in-depth view of any person. It is a treasure trove for criminals who commit identity theft and fraud.

Business Data is an Opportunity for Corporate Espionage

The data obtained through insurance scams becomes even more juicy when it combines personal and business information. Identity theft is truly a terrible threat. However, imagine a situation if the person that suffered the identity theft occupies an executive position at a company. Identity fraud could extend to the business as well.

Corporate data, including financial statements, payroll records, intellectual property details, and proprietary business strategies, could be at risk. At this point, corporate espionage, insider trading, or targeting specific organizations for ransomware attacks would be inevitable.

Critical Financial Transactions are Lucrative to Insurance Scammers

Insurance companies deal with financial transactions, making them an attractive target for financial fraud. Hackers seek to infiltrate email systems to intercept policyholder communications, manipulate payment instructions, or deceive customers into revealing financial account credentials. The potential economic gains from such attacks are immense, as insurance transactions often involve substantial sums of money.

Types of Email-Borne Insurance Scams

Most widespread insurance scams that travel via email start as phishing attacks. Insurance companies, agents, or executives can use these emails to deceive policyholders, employees, or partners. In the context of domain protection, phishing emails should seem to originate from a person that uses a company email.

As you might imagine, the email is fake and aims to mislead the receiver. While a phishing email is the method of delivery, here are a few tactics used to achieve success with insurance scams:

- Business Email Compromise (BEC): An attack tactic during which the bad actor aims to find and exploit the credentials of a higher-ranking official in a company.

- Employee Impersonation: Similar to BEC, this attack focuses more on getting the employee identity right (how they talk, who they usually communicate with, etc.).

- Ransomware Attacks: During a ransomware attack, the hacker keeps information hostage against a requirement (usually money ransom).

Now that we learned the methods, let’s explore the top 3 widespread insurance fraud emails based on their content:

- Policy Fraud: Fraudsters may send emails offering fake insurance policies or claiming to provide policy updates. They often attempt to collect upfront payments or personal information under the guise of offering insurance coverage. Policyholders who fall victim to these scams find themselves without legitimate coverage when they need it most.

- Claims Fraud: Fraudulent emails related to insurance claims are a significant concern. Scammers may send false claim notifications to request personal information or instruct recipients to click on malicious links. These scams aim to gather sensitive data or gain unauthorized access to systems, enabling other fraudulent activities.

- Premium Payment Scams: Cybercriminals may target policyholders by sending emails disguised as premium payment notices or overdue payment reminders. Fraudulent emails often contain links to malicious websites or fake payment portals. They aim to steal financial information or carry out unauthorized transactions.

If not sure, use is this link safe checker to check your links before clicking them.

Keep Your Company’s Name Out of Insurance Scam Lists

Any Insurance company, no matter its size and field, could become a target for bad actors. Company owners may mistakenly think they are too small to be hacked.

However, the size of a company is not a determining factor in whether or not hackers are interested. Instead, the value of the data is a more influential factor. Thus, as a legitimate company that has built or wants to build a name for itself, you must ensure domain spoofing and phishing cannot impact your reputation.

Sure, your insurance IT staff can spread awareness about insurance company scams among clients using tried and true general tactics. It’s also crucial to have policies that will hinder massive changes to insurance contracts via email or a phone call. You should also ensure that your customers are aware of them.

It’s much easier to stop fake emails from reaching your clients than to try and fix the consequences of cybersecurity failures.

The email authentication journey is a preliminary step for insurance businesses to avoid unwanted incidents like phishing and spoofing. The latter could open doors to terrible consequences like ransomware attacks, business email compromise, and data loss.

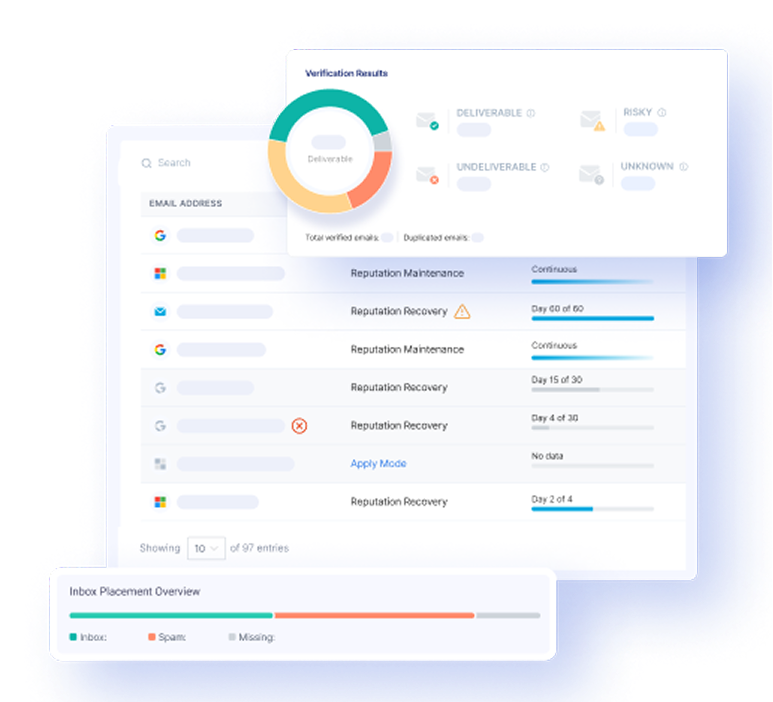

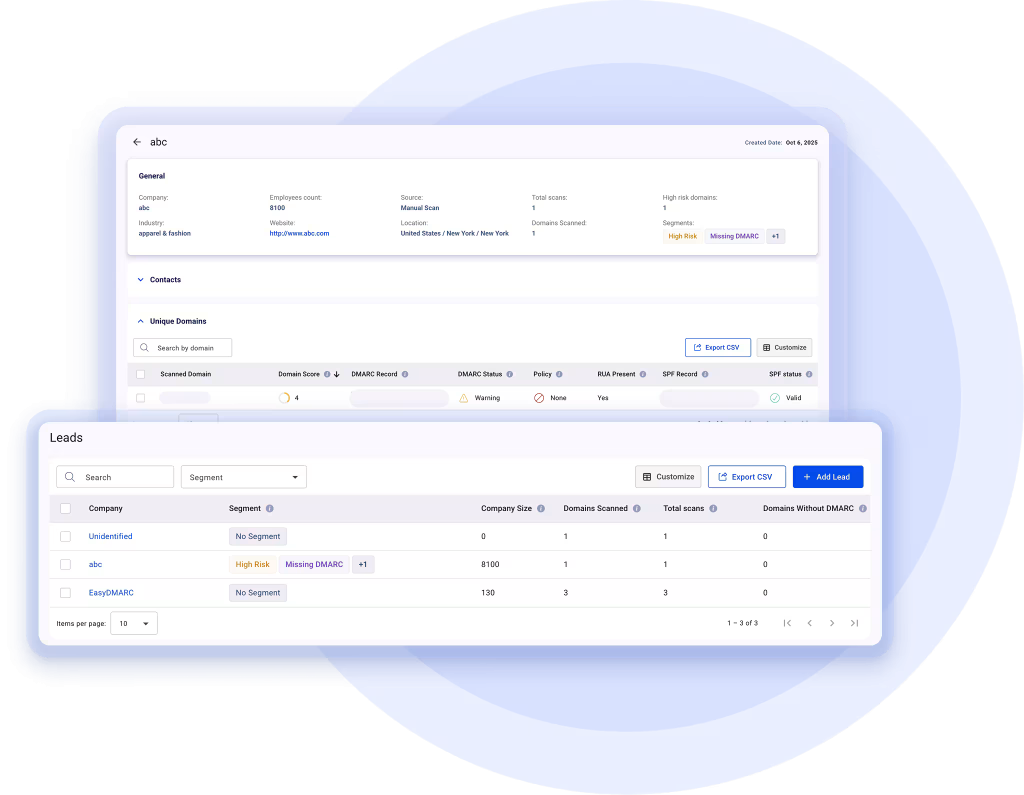

EasyDMARC has built a cloud-native innovative platform to make your email authentication journey swift and easy. You simply need to hit a few milestones:

- Configuring SPF and DKIM

- Adding the DMARC record

- Going through DMARC policy enforcement (none, quarantine, and reject)

- Crowning your authenticated email with the ultimate sign – BIMI

Reaching your domain protection goals is super easy with EasyDMARC. All you need to do is get in touch with our professional team and get your peace of mind (not unlike the one your clients get by trusting you.