- ProductsEasyDMARC

Outbound email security

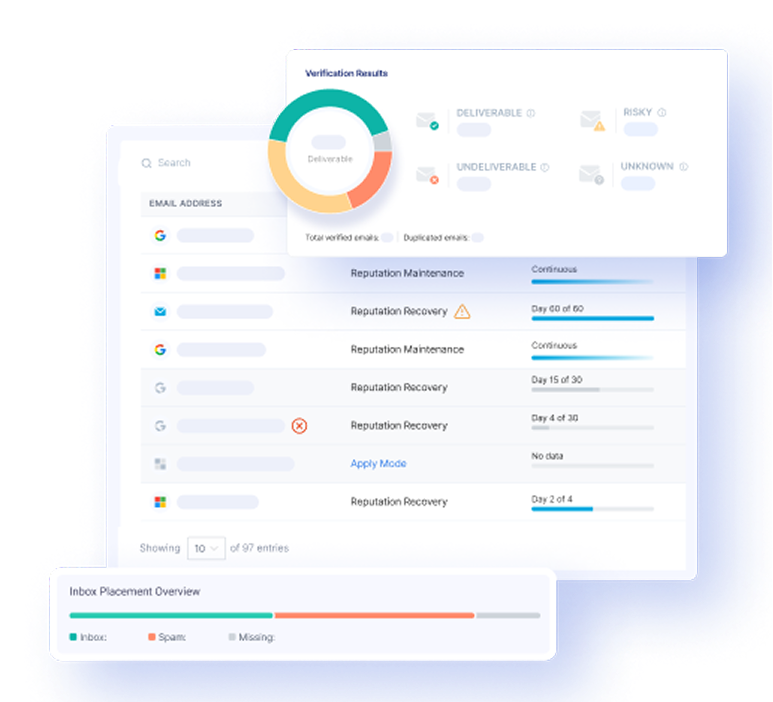

EasySenderEmail deliverability

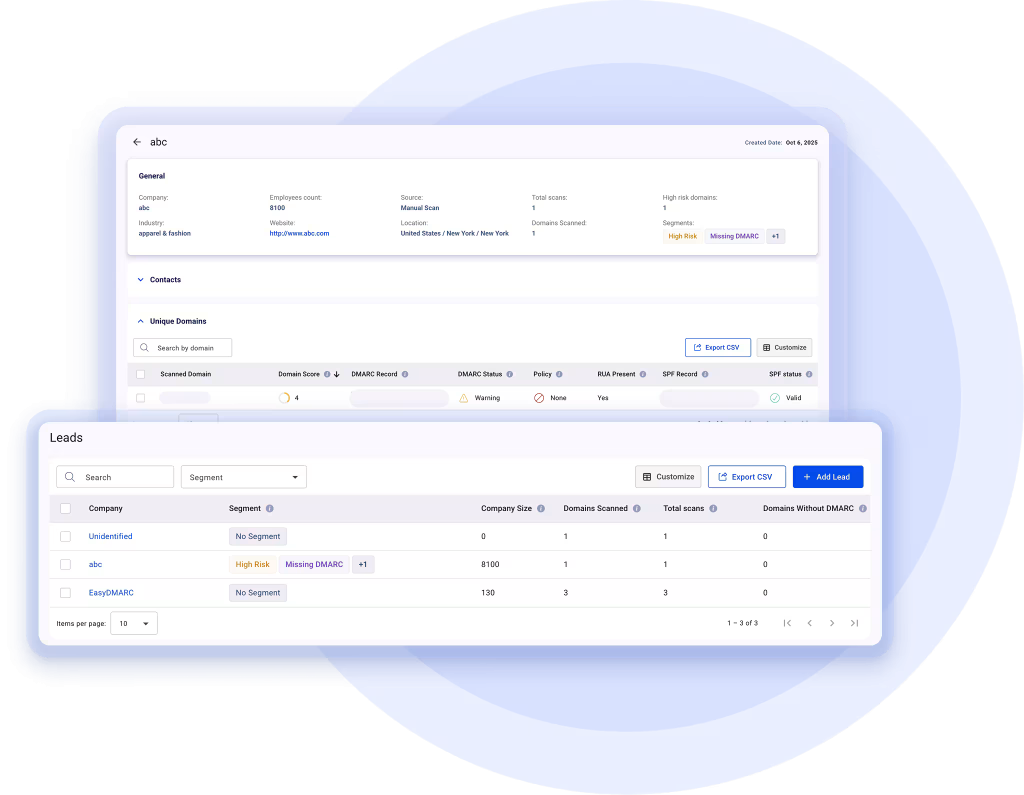

TouchpointMSP lead generation

MSPSimplify Your DMARC Experience

Solve email security issues in just a few clicks. Stay safe and maintain the health of your domains without risk.All-In-One Email Deliverability Platform

Reach maximum email deliverability by maintaining a good sender reputation. We help you to get the most out of your campaigns by increasing your opens, clicks, and reply rates.- Inbox Placement Tests

Signal-Based

MSP Pipeline.Qualified accounts, verified IT decision-makers, and buying signals in one place. Built for MSPs. - ToolsEmail DeliverabilityNew

- Pricing

- ResourcesMastering Email Protection and Implementation:

From Basics to Expert with EasyDMARC Academy

- Industries

- MSPs & Resellers

- ProductsEasyDMARC

Outbound email security

EasySenderEmail deliverability

TouchpointMSP lead generation

MSPSimplify Your DMARC Experience

Solve email security issues in just a few clicks. Stay safe and maintain the health of your domains without risk.All-In-One Email Deliverability Platform

Reach maximum email deliverability by maintaining a good sender reputation. We help you to get the most out of your campaigns by increasing your opens, clicks, and reply rates.- Inbox Placement Tests

Signal-Based

MSP Pipeline.Qualified accounts, verified IT decision-makers, and buying signals in one place. Built for MSPs. - ToolsEmail DeliverabilityNew

- Pricing

- ResourcesMastering Email Protection and Implementation:

From Basics to Expert with EasyDMARC Academy

- Industries

- MSPs & Resellers