Cybercrimes are common threats to organizations, leading to financial losses, legal fines, and disrupted business operations that can destroy reputations and businesses.

According to the Cyberthreat Defense Report (CDR), over 89.7% of businesses in the United States have experienced a cyberattack within 12 months, which is a 6.7% increase compared to 2020.

CyberEdge reports that 63% of ransomware attack victims paid the ransom, encouraging cyberactors to increase their attacks. Furthermore, cyberattacks have cost most US organizations millions of dollars in remediation.

Based on a 2021 report from Sophos, the average cost of a ransomware attack was around $761,000 in 2020, which increased by 50% in 2021 to a whopping $1.85 million.

Another report from Coalition, a US-based cyber insurance firm, stated that a large proportion (around 54%) of insurance claims within the first half of 2021 were due to social engineering or Business Email Compromise attacks.

Large organizations aren’t the only ones susceptible to attacks, though; cybercriminals also target small and medium-sized businesses (SMBs).

A successful cyberattack can be devastating, put your customers at risk, and severely harm your company. That’s why implementing a robust cyber insurance policy can be an intelligent decision for organizations to curb cybercrime.

In this post, we’ll discuss what cybersecurity insurance is and how it works. We’ll also cover the importance of DMARC in this context and why it’s vital to email and overall cybersecurity. Let’s dive in!

What is Cyber Insurance?

When it comes to the cost of remediating cyberattacks, we’re talking billions. But not all organizations can bear the hefty expenses. For that reason, providers offer insurance policies tailored to the evolving cybersecurity needs of their clients.

While you’re responsible for your company’s cybersecurity, having cyberinsurance provides the necessary support to ensure business continuity.

Cyber insurance, cyber liability insurance, or cyber risk insurance is a product companies can purchase to reduce the costs involved with recovery from social engineering attacks, BEC, ransomware, data breaches, and other forms of cybercrime.

Before you insure your company against cybercrime, consult an insurance broker to determine the best policy for your business. By doing so, you’ll know if you should opt for third-party coverage, first-party coverage, or both. Cyber insurance policies may include automatic coverage or other provisions tailored to your specific needs.

First-party coverage only covers costs incurred directly by your company following a successful cyberattack. Meanwhile, third-party coverage addresses costs from claims made by companies or clients affected by your activity or inactivity in a cyber event.

How Does Cyber Insurance Work?

Cyber insurance works similarly to other aspects of business insurance. It encompasses re-insurers, insurers, and brokers. To start the cyber insurance journey, your organization needs to work with a broker who will gather quotes from various insurers and find you the best, most cost-effective solution.

What Does Cyber Insurance Cover?

Cyber insurance policies vary among providers, and they’re usually based on business needs. So there are no standardized cyber insurance policies. However, some common issues that cyber insurance should address include:

- Financial loss due to data breach

- Data loss, recovery, and recreation

- Cyber extortion

- Cyber fraud

Organizations must understand that Error and Omissions insurance doesn’t serve as proper cyber insurance. While E&O can protect organizations against defects and faults in their services, it doesn’t cover the loss of third-party information, such as social security numbers, credit card details, and driver’s licenses. In the case of customer data loss, cyber insurance typically covers:

- Credit Monitoring

- Notification costs

- Computer forensics

- Reputational damage

- Civil damage

Organizations subject to privacy and information risk should include network security coverage as part of their cyber insurance policy. This covers the costs resulting from network failures.

Cyber security insurance providers should also cover and defend you in a regular investigation. This coverage usually falls under privacy liability coverage and is vital for companies that keep employee and customer information on their network.

A data breach can expose your business to liability lawsuits from victims. Privacy liability coverage also protects businesses against privacy law violations.

Who Needs Cyber Insurance?

Every organization that handles customer information, such as credit card details, names, addresses, social security numbers, etc., is responsible for securing such data. Numerous regulatory bodies govern privacy laws in the United States, including HIPAA, COPPA, and GLBA. Organizations that violate these laws must pay a considerable fee or face lawsuits.

Data breaches can cost businesses a huge amount of money. According to IBM’s 2022 Cost of Data Breach report, the average cost of a data breach has hit $4.35 million, a 2.6% increase from the previous year.

Why is Cyber Insurance Important?

Cyber insurance is still in its infancy, so it might not be the first thing that comes to mind when you’re thinking of insurance. There’s no denying that cyberattacks are increasing at an alarming rate and can cause great destruction to businesses. Hence the need for cyber insurance can’t be understated.

Regardless of its size, every organization in the US can be a cyberattack victim. Statistics have it that over 70% of companies experience cyberattacks. These stats show that SMBs experience as many cybercrimes as large organizations. In fact, the average cost of a data breach for SMBs ranges from $120,000 to $1.24 million.

Potential cybercrimes that threaten your business continuity include data breaches, identity theft, social engineering attacks, and compromised networks. All of these threats can cause severe damage to small businesses.

If you’re still doubting the importance of cyber insurance, consider the costs involved in recovering from potential attacks on your own. Statistics don’t lie, and you can see for yourself. In 2021, SMBs lost an average of $212,000 due to cyber incidents that affected suppliers with whom they share data.

Where Does DMARC Stand in the Cyber Insurance Issue?

Most cyber insurance claims come from similar attacks, including Business Email Compromise (BEC), ransomware, social engineering, brute force, and other phishing attacks. According to Shawn Ram, the Head of Insurance at Coalition, a business email is a common attack vector as cybercriminals continue to leverage vulnerabilities in email security protocols.

That’s where your DMARC Policy comes in. But what is DMARC? Anyway? It’s an email authentication standard that protects your domain from the exploits of cybercriminals while ensuring recipients only receive legitimate emails from your organization.

Poorly configured protocols like the Sender Policy Framework (SPF), Domain Message Authentication Reporting and Conformance (DMARC), and Domain Keys Identified Message (DKIM) to maximize phishing and spoofing attacks.

To solve these vulnerability issues, organizations must implement, improve, and maintain their email security protocols. Robust email security authentication protocols like DKIM, SPF, and DMARC are only effective if they’re correctly configured.

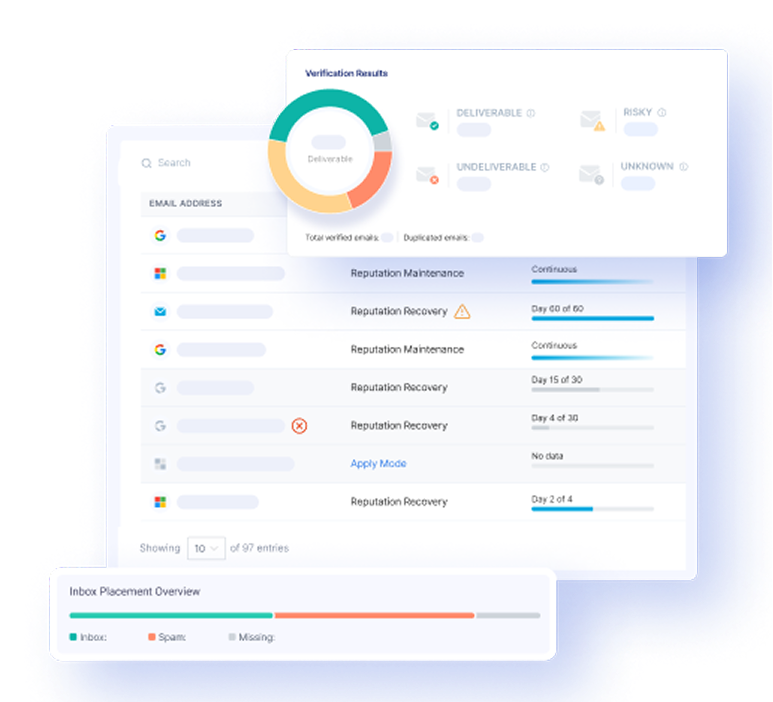

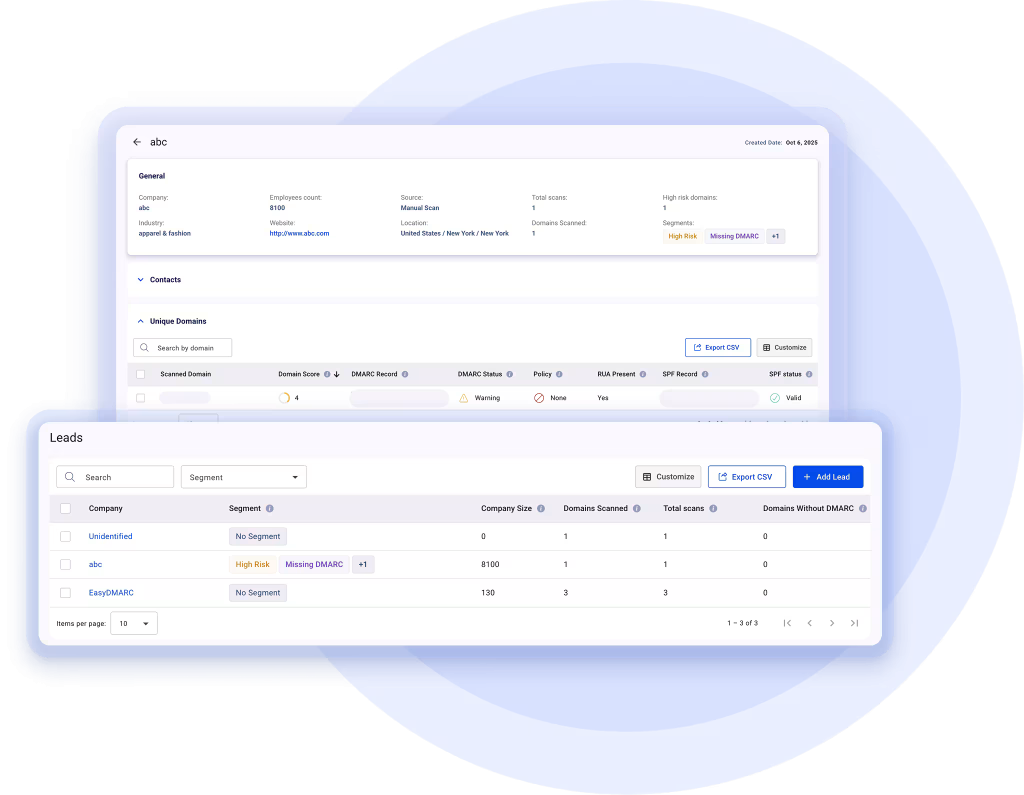

However, most businesses don’t know how to implement these protocols to keep their domains secure. At EasyDMARC, we help simplify the implementation process for DMARC, DKIM, and SPF email security policies. We have an all-in-one security solution where you can manage and improve your email authentication standards.

If you’re not sure about the status of your DMARC policy, you can use our DMARC Record Checker tool to lookup or validate your DMARC records. Need help to generate your DMARC records? Don’t stress, as our easy-to-use DMARC Record Generator helps create a DMARC record you can use in your DNS settings.

And that’s just the beginning. Contact us to find out how you can implement DMARC the EasyDMARC way, secure your domain, and protect your customers.

Final Thoughts

The cyberattack landscape is increasing massively, and so is the cost required to recover from these incidents. That’s why many organizations are implementing cyber insurance policies to reduce the recovery costs of a cyberattack.

Remember, DMARC plays a vital role in cyber insurance.

Nowadays, cyber insurance providers are including SPF, DMARC, and DKIM setup for their client’s insurance policies to deal with potential cyberattacks from BEC and other social engineering attacks.

This shows that implementing these email security protocols will go a long way in guarding your businesses against cybercriminals. Feel free to contact us if you need help with your DMARC setup. At EasyDMARC, we’ll be glad to help you!