About the Partner

Organization: fTLD Registry Services

Role: Registry Operator for .Bank and .Insurance

Website: https://www.fTLD.com

Industry: Domain Registry, Financial Services, Cybersecurity

fTLD Registry Services operates the trusted .Bank and .Insurance top-level domains (TLDs), reserved exclusively for verified members of the banking and insurance industries. These highly secure domains offer financial institutions enhanced protection from phishing, spoofing, and impersonation — key threats in today’s rapidly evolving cybersecurity landscape.

The Challenge: Ensuring Consistent, Robust Email Authentication

According to Heather Diaz, Vice President of Compliance and Policy at fTLD, one of the most common challenges financial institutions face is properly implementing and maintaining email authentication standards (i.e., DMARC, SPF, and DKIM).

“Many businesses have improper configurations, or they don’t perform continuous monitoring. And a lot of organizations don’t have their DMARC at enforcement, which is important for protecting their reputation from bad actors.” One of fTLD’s Security Requirements is that DMARC be at enforcement within 90 days of use of the domain for email.

For banks and insurance providers, this challenge is further complicated by the complexity of their digital ecosystems, including third-party vendors who send email on their behalf. Without proper visibility and enforcement, these institutions remain vulnerable to phishing, business email compromise (BEC), and fraud schemes.

The Solution: Scalable Protection for a Critical Industry

fTLD’s mission is to protect its community of verified domain holders from cyber attacks, especially those targeting their most vulnerable channel: email.

“Phishing continues to be a primary attack vector targeting banks and insurance companies. With the advent of AI, phishing emails are increasingly polished, personalized, and virtually indistinguishable from legitimate email.”

Through its affiliate partnership with EasyDMARC, fTLD offers registrants a seamless path to email authentication maturity.

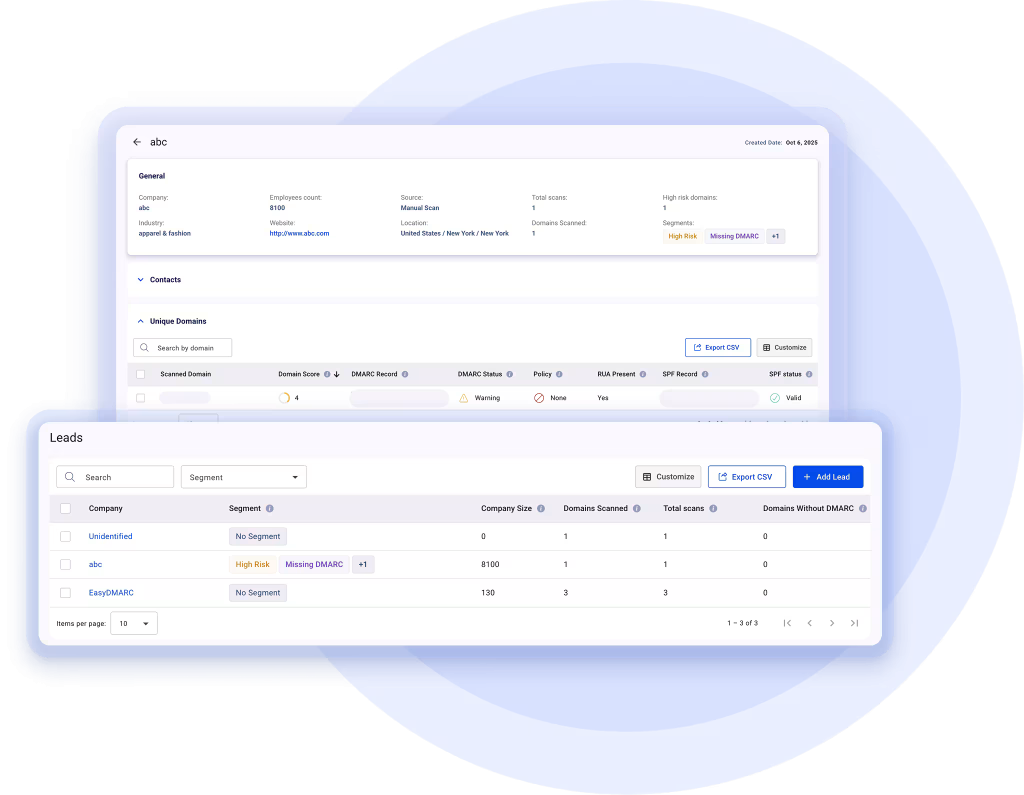

“EasyDMARC gives them the right insights to ensure they have DMARC, SPF, and DKIM properly implemented, as well as monitoring their email channel to prevent impostors from deploying their scams or attacks.”

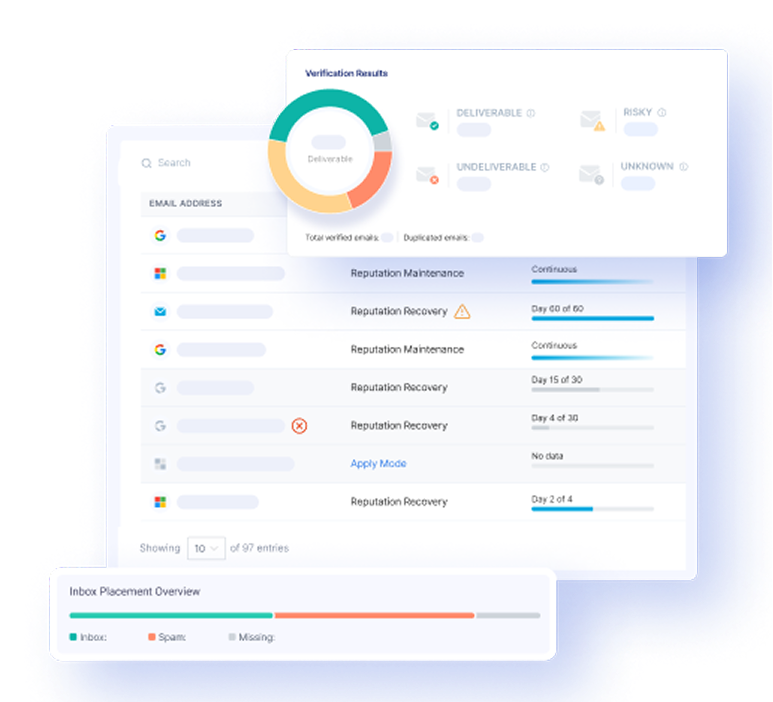

EasyDMARC provides .Bank and .Insurance domain holders the critical tools and insights needed to manage their email ecosystems effectively. Institutions can identify misconfigurations, monitor sender behavior, and implement strict authentication policies, all through a streamlined and intuitive interface.

The Results: Enhanced Oversight and Confidence in a High-Stakes Industry

Since partnering with EasyDMARC, fTLD has observed significant improvements in how domain holders oversee and protect their email channels. Heather explains:

“Spoofing and impersonation through email continues to be a primary way attackers conduct fraud and data breach schemes. Many financial institutions are prime targets for executive impersonation and BEC. Having monitoring and service through EasyDMARC is important, especially when vendors are sending email on their behalf.”

By using EasyDMARC, .Bank and .Insurance domain holders can not only guard their customers’ data, but also strengthen their reputation and readiness in the face of evolving threats.

The Partnership: Trusted, Affordable, and Collaborative

Heather describes fTLD’s collaboration with EasyDMARC as efficient and supportive.

“It’s been a great partnership. Alex Nye from your team is wonderful to work with and really helps our customers understand how EasyDMARC lives up to its name. He makes it straightforward for them to get started.”

The combination of accessible support, a user-friendly dashboard, and affordable pricing makes EasyDMARC an ideal partner for organizations looking to secure their email channels with minimal friction.

“Any business that isn’t yet using a provider in the email authentication space should surely look into working with EasyDMARC for peace of mind, security, and maturing their email security program.”