The insurance sector is a prime target for cyberattacks, with ransomware damages projected to hit $57 billion by 2025. Insurers, holding vast capital and sensitive data, are uniquely vulnerable.

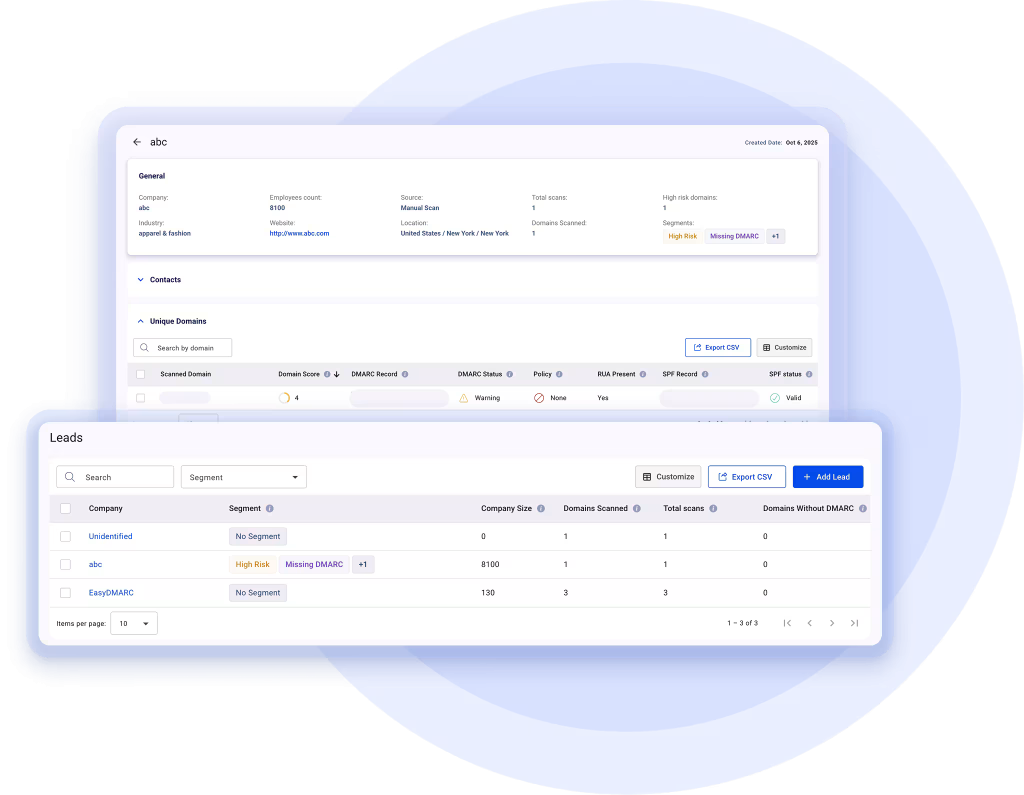

Our recent research paints a clear picture: out of 12,103 insurance companies surveyed, only 22% had deployed a DMARC policy. This alarming figure means nearly 80% leave their domains wide open for exploitation, risking fraud against policyholders and theft of confidential data. Even among those with a policy, 1,401 agencies use p=none, which monitors but doesn’t stop malicious emails.

There are many cases that highlight the profound damage cybercriminals inflict when insurance organizations lack proper email authentication. DMARC is like insurance for your email – a vital protocol that stops dangerous, malicious emails from ever reaching your inbox.

Our new ebook, tailored specifically for the insurance sector, details these threats and explains how implementing DMARC, alongside SPF and DKIM, can truly protect your domain. Don’t leave your organization exposed to escalating cyber threats; download our report today.